Is It Better to Pay Off Subsidized or Unsubsidized First

First-Time Borrowers. Quick tip Keep in mind the differences in each type of loan you have such as subsidized versus unsubsidized or private loans which likely have different annual percentage rates and interest.

Federal Student Aid 在 Twitter 上 Thanks To Everyone Who Replied The Correct Answer Is False You Are Responsible For Paying The Interest On A Direct Unsubsidized Loan During All Periods Learn More

Its possible to consolidate federal student loans Federal Perkins Direct subsidized Direct unsubsidized and Direct PLUS loans with a Direct Consolidation Loan from the Department of Education but this will not allow you to lower your interest rate or select a variable rate loan and private student loans are not eligible.

. The debt avalanche method can help. Her work has been published by Experian Credit Karma Student. However if youre a single mom who needs student loan debt relief any of the above may be an option depending on your career the state you live in and other circumstances.

Standard repayment plans for federal student loans set a timeline of 120 months until payoff but the minimum monthly payments are 50. LOAN TYPE BORROWER FIXED INTEREST RATE LOAN FEE. If the interest that accrues on your subsidized loans each month is greater than your payments under PAYE or IBR the government will pay the difference.

Direct Subsidized Loans and Direct Unsubsidized Loans Undergraduate students. Student loan borrowers were among the first to get relief when the COVID-19 crisis crippled the US. For example if youre a dependent undergraduate and borrow the full amount of subsidized loans your first year 3500 you can only borrow another 2000 in unsubsidized student loans.

Kat Tretina is is an expert on student loans who started her career paying off her 35000 student loans years ahead of schedule. Federal loans have different limits. Interest accrual begins immediately and the student can choose to pay the interest while enrolled or upon entering repayment.

But if you didnt qualify for any subsidized student loans then you can borrow up to the full 5500 in unsubsidized federal direct loans. They depend on the type of student loan what year of school the student is applying for as well as whether the student is considered a dependent relying on their parentsguardian for financial support or independent. 1 2020 and.

On March 13 2020 the Federal Student Aid office acting under an executive order from President Donald Trump suspended monthly loan payments stopped collection on defaulted loans and reduced the interest rate to 0 on Direct. Scholarships360 was founded by two first-generation college students who understand the pains of paying for college. Undergraduate students and graduate students regardless of their need qualify for an unsubsidized loan provided they have filed the Free Application for Federal Student Aid FAFSA.

In this example it would take me much less time and much less money to pay back a subsidized loan vs. We vet all scholarships on the site All scholarships are reviewed by a trained research staff and all content is approved by our team of experts. Interest on subsidized student loans is paid by the federal government while students are in school with at least half-time status and a few other circumstances.

Try the debt avalanche or debt snowball strategies. Be regularly admitted to and enrolled at Mercy College as a matriculated student. Grants to pay off student loans for single mothers This one is a bit difficultthere arent a lot of student loan forgiveness programs specifically for single mothers.

Theres more than one way to pay off debt. Be enrolled full time - To be eligible for many types of scholarship and financial aidFull time means 12 credits per semester as an undergraduate. For students most federal student loans are either issued as subsidized or unsubsidized loans.

Youll have to pay any interest that accrues while youre in school and during grace periods or deferments resulting in higher total loan costs and monthly payments than you would rack up with a subsidized loan as the. Department of Education are a common example. A general rule of thumb is to either pay off your highest interest debt or focus on the smallest outstanding balances the snowball method first.

Unsubsidized Loans Direct Unsubsidized Loans offered by the US. These loans should be used to their limit before taking any other type of student loan. Citizen or eligible non-citizen - Students with permanent resident status must provide alien registration information.

One nice perk of both IBR and PAYE is their interest benefit for subsidized loans. Theres a limit on the number of academic years that you can receive direct subsidized loans for those who fall. When you go off to college especially if your parents arent chipping in to pay for tuition or room and board you may feel like youre independent.

373 1057 for loans first disbursed on or after Oct. Both plans have interest benefits but PAYE has a better one.

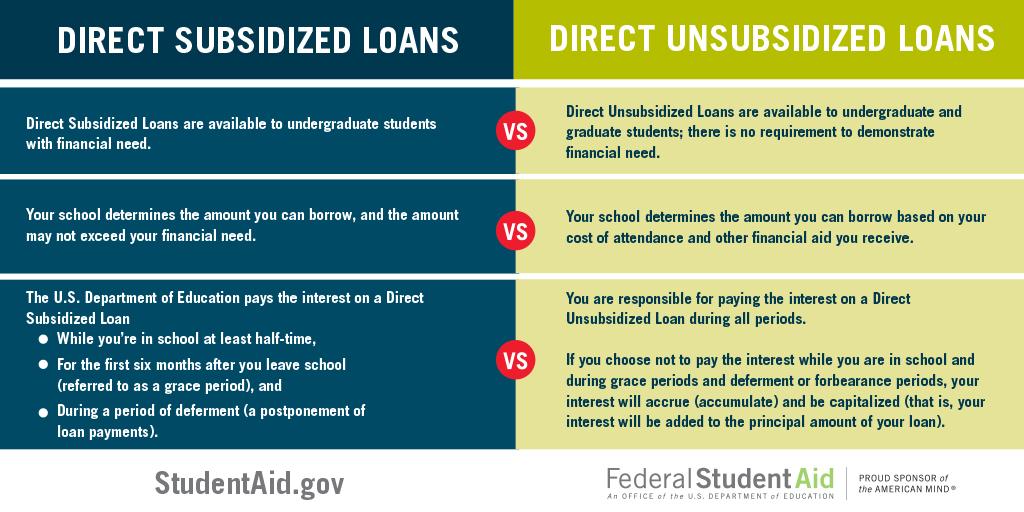

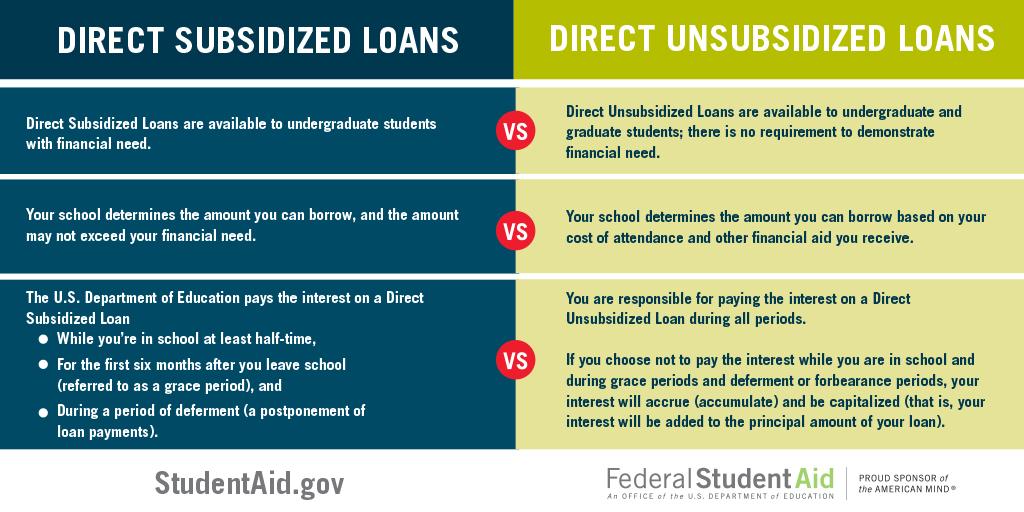

Federal Student Aid On Twitter What Is The Difference Between Subsidized And Unsubsidized Loans Find Out Http T Co Gz9nnvpavy Http T Co Nsig6dmckh Twitter

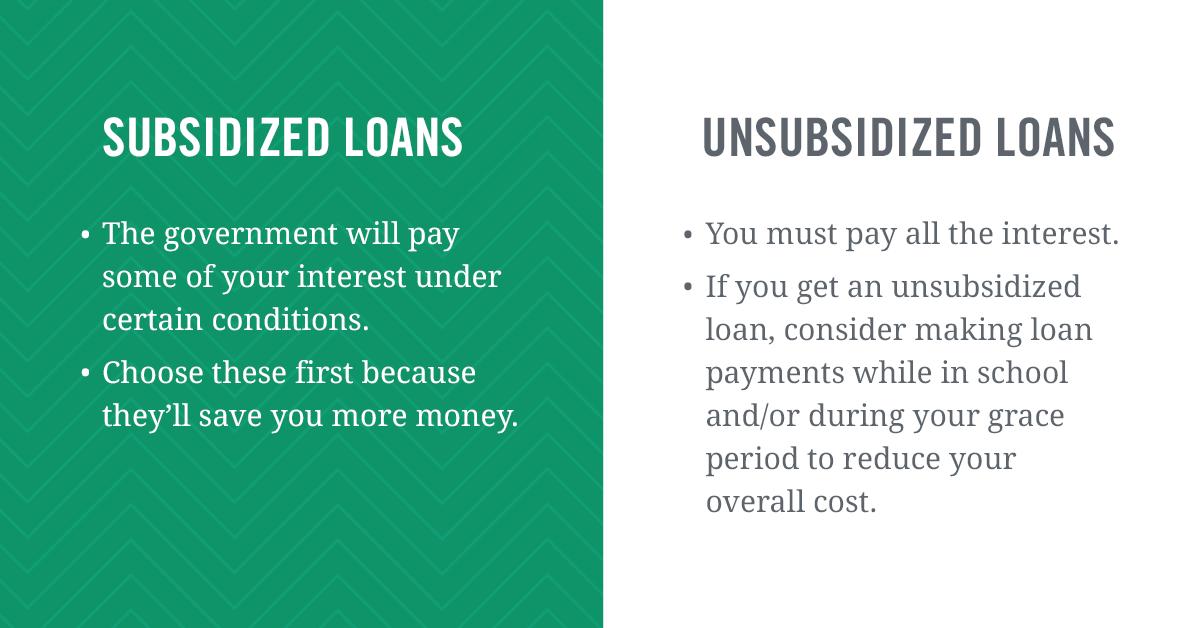

Subsidized Vs Unsubsidized Loans What S The Difference

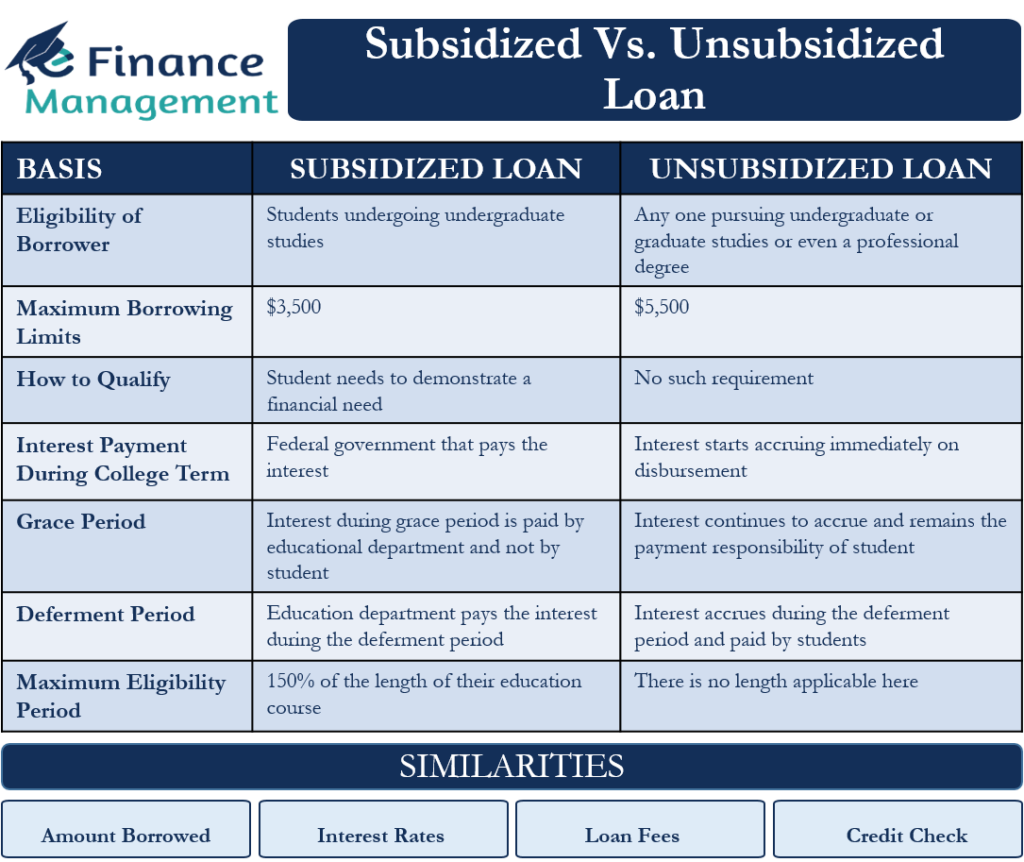

Subsidized Vs Unsubsidized Loan Differences And Similarities Efm

No comments for "Is It Better to Pay Off Subsidized or Unsubsidized First"

Post a Comment